$200M Manipulated: Zelensky, Polymarket, and Shades of Jane Street’s Trading Scandal

How whales can find a way to manipulate anything: from DeFi to TradFi markets

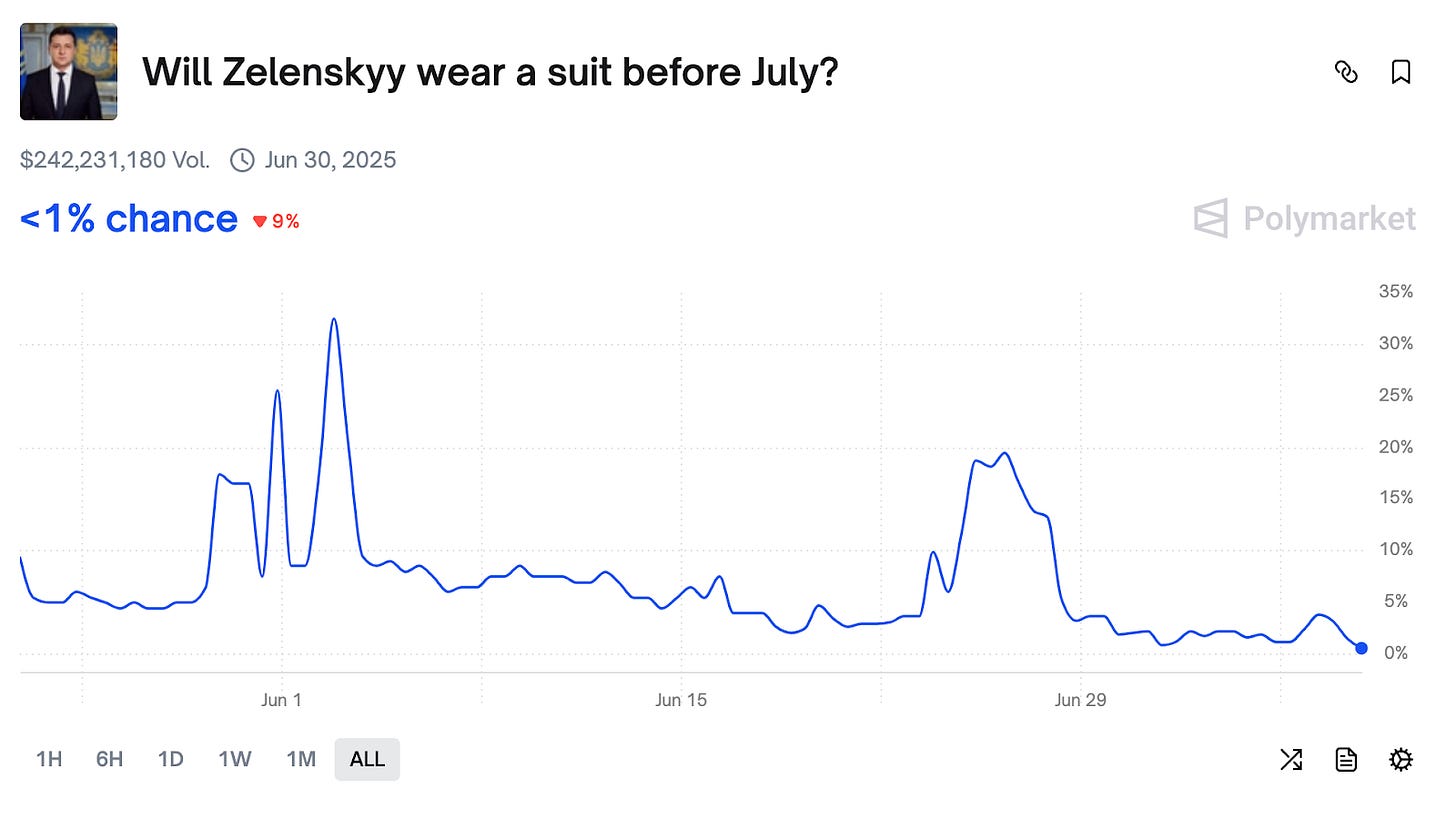

Imagine throwing hundreds of millions on a bet about a president's wardrobe. That's exactly what happened on Polymarket, the Gen Z playground for high-stakes predictions. The question? “Will Zelensky wear a suit before July?” What seemed like a harmless fashion forecast exploded into a $200 million disaster, revealing cracks and allegations of manipulation similar to Jane Street's $3.2 trillion derivatives scandal in India.

The Zelensky Suit Market Explained

Prediction markets like Kalshi and Polymarket are essentially sophisticated betting platforms where everyday users can wager YES or NO on future events. Each “contract” trades between $0 and $1 and is meant to imply the market’s sentiment on an event happening. The main difference: Kalshi is CFTC-regulated, can legally operate in all 50-states, and has clear settlement rules that are managed by the Kalshi team, while Polymarket is unregulated, technically “banned for US users”, and leverages decentralized resolution through UMA’s oracle system that is the core of this entire controversy.

The markets listed on these exchanges range from serious trading like the consumer price index every month to pure meme-material (like whether Jesus will return in 2025). Call it a meme market if you want, but any market that does $200 million dollars in volume should be taken seriously (for reference: ABNB (Airbnb Inc.) averages around ~$400 million dollars of volume on a given day recently).

So why did this market become so controversial?

On June 24th, Zelensky attended the NATO summit in The Hague and wore the above military style blazer. Everyone largely agreed it was a suit but it was not universally agreed (imo this is clearly a suit 🫡 ✊🏿)

Multiple news outlets reported Zelensky wearing a suit (this is especially relevant because Kalshi usually settles markets if there is agreement among news sources).

NY Post: Zelensky ditches T-shirt for a suit for sit-down meeting with President Trump

BBC: Zelensky swaps military fatigues for black suit at Nato summit

A Polymarket affiliated X account even tweeted that Zelensky was in a suit.

Polymarket itself didn't help clear things up, publishing an extremly vague resolution criteria:

This market will resolve to "Yes" if Volodymyr Zelenskyy is is photographed or videotaped wearing a suit between May 22 and June 30, 2025 ET. Otherwise, this market will resolve to "No".

For this market to resolve to "Yes" the images or video must be taken and released within this market's timeframe. The images or video must be authentic, not the result of artificial intelligence or video editing.

The resolution source will be a consensus of credible reporting.

WTF is the definition of a suit? WTF constitutes credible reporting?

Ok… regardless the market should resolve to yes. Right?

Shit Hits the Fucking Fan

Long story short, the market resolves “No”—and suddenly, Polymarket’s entire approach to resolution is exposed as fundamentally broken.

So how in the world did this happen? Enter: the UMA whales, gaming a so-called “decentralized” system.

Unlike Kalshi, which has a dedicated team reviewing and settling each market with clear, transparent rules, Polymarket outsources the whole process to UMA’s Optimistic Oracle.

Here’s how the resolution flow actually works:

Proposal Submission

When the event’s outcome is supposed to be known, anybody can propose the event’s outcome to the oracle by posting $750 USDC bond (this is to prevent trolls spamming the oracle with bullshit outcomes)

In this case, the proposer proposed (“Yes, Zelensky wore a suit”). Everything is right in the universe… for now.

Dispute Window (2 hours)

Polymarket has a 2 hour dispute window where anyone can dispute the proposed resolution by also posting a $750 USDC bond.

This is supposed to catch obvious mistakes or malicious proposals.

In this case, the proposal for “Yes, Zelensky wore a suit” was disputed and the disputer proposed that the market should resolve to No. That’s fucking weird.

Dispute Escalates

Here’s where all the sus shit happens. Once there’s a dispute, the outcome isn’t decided by logic, facts, or credible reporting. The whole thing gets punted to UMA’s “Data Verification Mechanism” (DVM) which might be one of the stupidest human inventions ever.

The DVM is basically a vote among all UMA token holders—think of these tokens as equity-like securities that anyone can buy or sell.

The outcome of the market is now in the hands of whoever holds the most UMA tokens.

So why is this problematic?

Here come the UMA Whales

The issue with all this is that the entire market cap of UMA tokens is only $102.50 million (as of July 11, 2025) -- compared to the over $15B in all time polymarket volume, making it easy for a few whales to buy up a massive supply of $UMA tokens and essentially manipulate any dispute.

In fact, if you look at the token report from Sentora: 95% of the stock of UMA is concentrated into large holders.

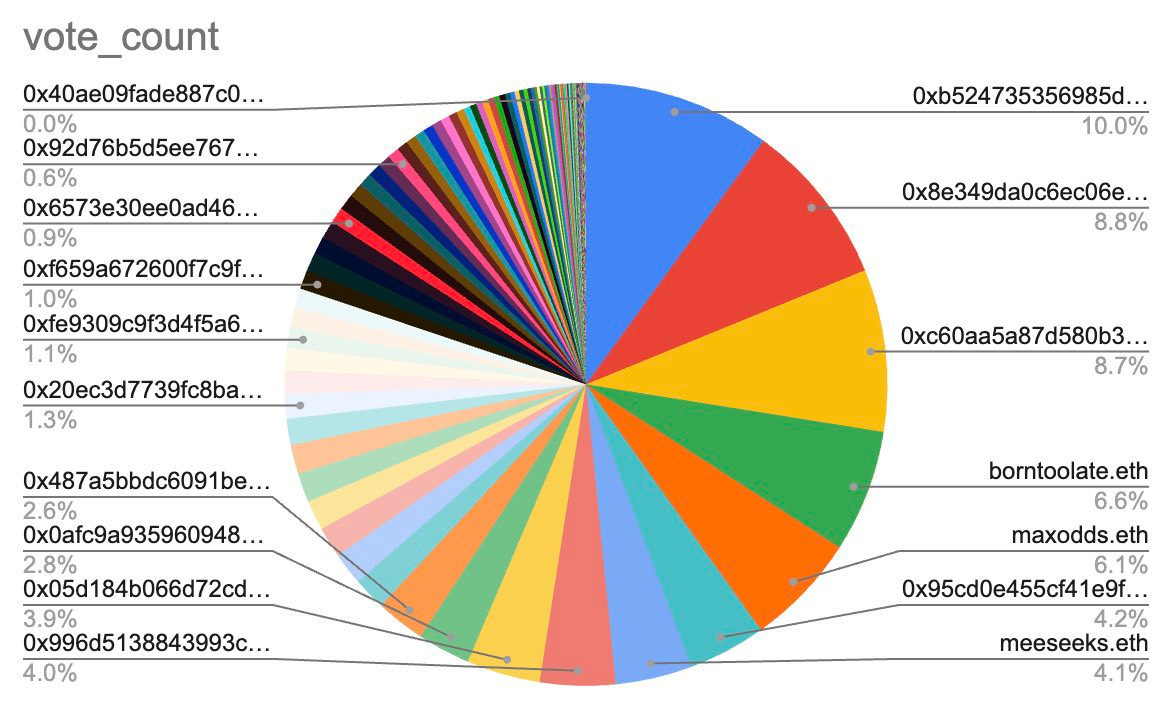

This was pretty darn evident in the “Data Verification Mechanism” (DVM) vote for the Zelensky suit market.

Here are the official vote metrics distributed by UMA.

But if we deep dive into a pie chart of the votes based on holders, we see that there’s some whaling going on here (shoutout Atlantis Liquidity for this graphic). 10 wallets control over 60% of the vote and the top 3 hold 27.5%.So how did these whales profit off manipulating the market? Well since Polymarket is an unregulated platform, there are no rules preventing UMA whales from also participating in Polymarket betting, creating the perfect backdrop for what I like to call the “market manipulation whale playbook”.

Step 1: Target a Vague Market

Whales look for markets with fuzzy or subjective resolution rules, where outcomes aren’t black and white.

Step 2: Place Big Bets

They take massive positions on Polymarket, knowing they can influence the final outcome.

Step 3: Dispute the Obvious

When the expected (and factually correct) result is proposed, whales dispute it, escalating the decision to UMA’s DVM.

Step 4: Coordinate Voting Power

With the majority of UMA tokens in a few hands, whales band together to swing the DVM vote, regardless of what the evidence or consensus says.

Step 5: Cash Out—Twice

By controlling both the dispute resolution and the betting market, whales can lock in profits from both their bets and the DVM voting rewards.

You get rewards for voting for the “settled upon” outcome and token holders who vote against lose the tokens they stake.

This basically sounds like an infinite money glitch; and the Zelensky suit isn’t a standalone incident. This has happened before in

WTF does Jane Street have to do with anything?

Well… nothing really. But people who have been following the financial news this week might notice some huge parallels with Jane Street’s alleged “manipulation” in the Indian derivative markets that made them over $4.3 billion dollars in a two year period.

For those unfamiliar with Jane Street, Jane Street is one of the most successful quantitative trading and market making firms in the world -- they trade in almost every single market and made $20.5 billion in net trading revenue in 2024.

The core playbook is eerily similar to the Zelensky suit controversy. In India, Jane Street is accused of accumulating big positions in less liquid individual bank stocks—where their trades could move the price more easily—and then exploiting those movements to maximize profits from their far larger options bets. After working the stocks to nudge prices, they’d swoop in to cash out on options contracts made artificially juicy by their earlier moves—then unwind their stock positions

And why does this work? Because the underlying stocks are much less liquid than the options market. It takes much less capital to move the prices of these things, which in turn can swing the value of much bigger, more liquid derivatives positions. In effect, Jane Street could enter enormous options bets—and then spend way less money to push the underlying stock’s price just enough to realize massive gains on those options (if readers want more detail: I recommend this LinkedIn Post).

This playbook should sound familiar, because the same structural vulnerability is at the heart of both the Jane Street episode and Polymarket’s Zelensky suit situation: if you can concentrate control over a thinner, less accessible part of the system, you can weaponize it to move the much larger market that depends on it.

Wait how does it work?:

In Jane Street’s case (allegedly):

Underlying: Individual bank stocks (illiquid, easy to push in the right window)

Derivative: Bank Nifty options (highly liquid -- huge prize pool)

Control mechanism: Drop capital at just the right time to swing the stocks and juice the options.

In the UMA-Polymarket case:

Underlying: UMA governance tokens (ownership highly concentrated, easy for a few to control)

Derivative: Polymarket prediction markets (wide participation, also huge prize pool)

Control mechanism: Get enough voting power via UMA tokens to swing disputes in your favor and dispute your markets in your favor

In both models, concentrated power over a relatively illiquid core asset translates to outsized influence/profit over a much bigger, liquid market.

What does this mean for Polymarket?

It’s difficult to predict the fallout, but there’s definitely a crisis of confidence. The whole premise of prediction markets is that they aggregate collective wisdom. But if the outcome can be bought, WTF is the point?

To make matters worse, Polymarket’s response—or lack of—has only frustrated the community more. When the Ukraine Mineral Deal market incident happened, Polymarket issued an announcement (above) acknowledging the controversy and attempting to address community concerns to their discord community. In the case of the Zelensky suit market, however, there’s been radio silence from the team. 👻👻👻👻

Retail traders have already historically been skeptical of institutional manipulation and this episode feels eerily like Polymarket’s gamestop moment. We’re already seeing retail traders on Polymarket band together under a common cause against UMA whales and the Polymarket platform.

The Big Questions

Will there be a mass migration to Kalshi?

With Kalshi’s regulated structure and clear settlement rules, some traders may seek the safety and fairness of a regulated platform.

Will Polymarket’s core business take a hit?

If trust continues to erode and the platform is seen as a playground for whales rather than a true prediction market, Polymarket could see a significant decline in volume and user engagement.

The 2hr dispute window seems too small, especially for the small markets. If only a few people are significantly invested in that market, feels like something could slip through off-hours.